Cintron v. Vaughan

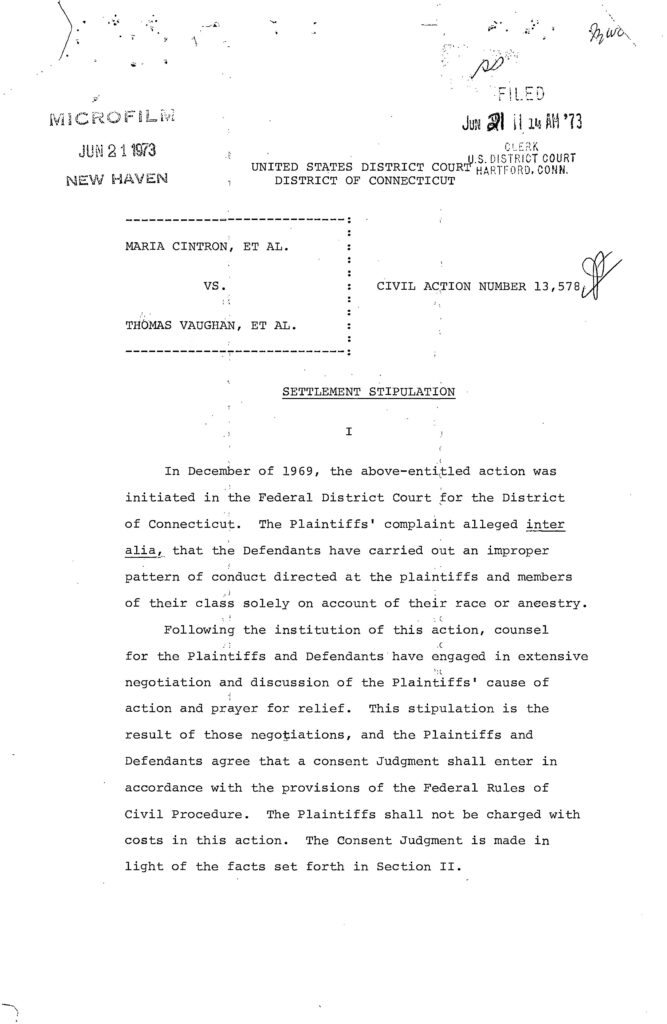

This project tracks the fifty-year lifespan of Cintron v. Vaughan, a consent decree which placed the Hartford Police Department (HPD) under judicial oversight from 1973 to 2023. The case began as a class action lawsuit brought in 1969 against members of the HPD and city government by community organizations as well as Black and Latinx citizens who had experienced police abuse. Cintron may be the first and longest-running consent decree entered into by a U.S. police department, and yet it is relatively unknown in discourses surrounding police reform.

This project tracks the fifty-year lifespan of Cintron v. Vaughan, a consent decree which placed the Hartford Police Department (HPD) under judicial oversight from 1973 to 2023. The case began as a class action lawsuit brought in 1969 against members of the HPD and city government by community organizations as well as Black and Latinx citizens who had experienced police abuse. Cintron may be the first and longest-running consent decree entered into by a U.S. police department, and yet it is relatively unknown in discourses surrounding police reform.

In keeping with the CCP’s humanistic lens, this study attends to the narratives hidden beneath the legal record, beginning with the context of Hartford’s fraught police-community relations in the late 1960s and the dedicated efforts of local organizations who pushed for accountability. Thirty years after the initial lawsuit, which gave voice to systematic racialized violence in Connecticut’s capital city, the case erupted anew with the police shooting of fourteen-year-old Aquan Salmon in 1999. A new generation of local organizers again turned to Cintron v. Vaughan as a vehicle for change, a process which continued to play out in extensive negotiations between the HPD and the Cintron Negotiating Committee for the next two decades.

Taken as a case study into the complicated relations undergirding change “within the system,” this research gestures toward the future of reform efforts in the U.S.